Carrian Group

Corporate Fraud Scandal

CLASSIFICATION: Financial Crime

LOCATION

Hong Kong

TIME PERIOD

1983

VICTIMS

1 confirmed

Carrian Group, a Hong Kong conglomerate founded by George Tan in 1977, collapsed in 1983 amidst a significant corruption and fraud scandal, marking the largest bankruptcy in Hong Kong's history. The group, which had rapidly expanded its operations across multiple countries, became embroiled in allegations of accounting fraud linked to Bank Bumiputra Malaysia Berhad and its subsidiary, culminating in the murder of a bank auditor and the suicide of a financial adviser. Key figures involved included founder George Tan and various banking officials, with the scandal revealing that the group's capital was primarily sourced from loans rather than legitimate investments. As of now, Carrian Group remains defunct, with little trace of its operations, although a restaurant named Carriana exists, loosely associated with the former conglomerate.

There are widespread beliefs that Carrian Group's rapid expansion was funded by questionable sources, with speculation linking its capital to figures such as Imelda Marcos, Gosbank, and a lumber corporation in Borneo. The collapse of the conglomerate amidst corruption and fraud allegations has led to theories about the extent of financial misconduct and the involvement of high-profile individuals in the scandal. Additionally, some speculate that the group's downfall was orchestrated by rival business interests aiming to undermine George Tan's influence in the market.

The Rise and Fall of the Carrian Group: A True Crime Saga

The Birth of a Conglomerate

In the bustling, opportunity-laden streets of Hong Kong, in 1977, a man named George Tan Soon-gin laid the foundation for what would become one of the most infamous conglomerates in history: the Carrian Group. Tan, a former Singaporean businessman who had fled his home country following a bankruptcy in 1974, sought a fresh start and a chance to build an empire from the ground up.

By 1979, Tan acquired a holding company for a staggering HK$700 million, transforming it into Carrian Investment Limited (CIL). This was no small feat, as Carrian Holdings Limited (CHL), a private entity, controlled 53% of CIL's equity, while another company, Carrian Nominee, held all shares of CHL. The stage was set for what would become an extraordinary, albeit short-lived, business saga.

A Spectacular Ascent

The dawn of the 1980s saw Carrian making headlines with an audacious real estate transaction. In January 1980, a 75% owned subsidiary of the group acquired Gammon House—now known as the Bank of America Tower—in Hong Kong's Central District for HK$998 million. This transaction marked the most expensive real estate purchase in Hong Kong's history at the time. Just a few months later, in April, Carrian announced the sale of Gammon House for an astounding HK$1.68 billion, raising eyebrows and capturing the attention of both property and financial markets. This maneuver not only generated a significant return on investment but also piqued public interest in the Carrian Group.

Seizing the momentum, Carrian capitalized on its newfound notoriety by acquiring a publicly listed company, renaming it Carrian Investments Ltd., and using it as a vehicle to draw funds from financial markets. The conglomerate grew at a breakneck pace, expanding its reach across the globe with properties in Malaysia, Thailand, Singapore, the Philippines, Japan, and the United States. As the empire expanded, so did the whispers of its mysterious financial backing. Was it the wealth of Imelda Marcos, the Soviet Union's Gosbank, or perhaps a lumber corporation in Borneo? The source of Carrian's vast capital remained a tantalizing mystery.

The Scandal and Collapse

The Carrian Group's meteoric rise was matched only by its catastrophic downfall. In 1983, the conglomerate became embroiled in a scandal involving Bank Bumiputra Malaysia Berhad and its Hong Kong subsidiary, Bumiputra Malaysia Finance. Allegations of accounting fraud surfaced, casting a shadow over Carrian's operations. The scandal deepened with the murder of a bank auditor and the suicide of the firm's advisor, events that shook the very foundations of Hong Kong's financial world.

By 1983, the Carrian Group had collapsed in what became the largest bankruptcy in Hong Kong's history. The scandal peeled back layers of secrecy, revealing that Carrian's seemingly endless capital was nothing more than a facade, propped up by loans from various banking institutions.

The Echoes of Carrian

In the aftermath of its downfall, almost no tangible traces of the Carrian Group remain. However, its legacy lingers in unexpected places. Carriana, a Hong Kong restaurant specializing in Teochew cuisine, was loosely named after the conglomerate due to connections between one of its former owners, Chim Pui-chung, and Carrian. Today, Carriana is a listed company in Hong Kong, a subtle nod to its infamous past.

During its heyday, Carrian dabbled in a myriad of ventures, from pesticides to tourism, shipping, insurance, taxi fleets, and restaurants. Yet, it was the real estate sector that remained its core business, the arena where its most dramatic successes and failures played out.

Carrian in Popular Culture

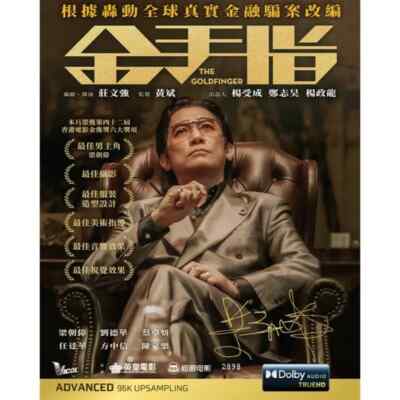

The intrigue surrounding the Carrian Group's rise and fall has not been lost on popular media. In 2020, the TVB drama series "Of Greed and Ants" explored the scandal's many facets, drawing inspiration from the real-life events that captivated Hong Kong. More recently, the 2023 film "The Goldfinger," produced and distributed by Emperor Motion Pictures, brought the saga to the silver screen, premiering on December 30, 2023.

Sources

For further exploration of the Carrian Group's dramatic history, interested readers can refer to the following resources:

- Vengadesan & Sagayam, 2019, p. 72.

- Naylor, 2004, p. 209.

- Fung, 2017, p. 45.

- "Carrian fraud trial opens in Hong Kong," The Sydney Morning Herald, February 19, 1986.

- "Carrian Receivers," The New York Times, October 19, 1983.

- Chow, Hin, "此馬來頭大的佳寧娜," am730, November 16, 2016.

- Bangsberg, P.T., "Hong Kong Acquits Defendants In Costly Carrian Fraud Case," joc.com, September 15, 1987.

- Wong, Zi Hang, "【黃金有罪】參考真實「佳寧案」," January 8, 2020.

- "专访《金手指》导演庄文强," January 1, 2024.

For more detailed analysis, check out the Independent Commission Against Corruption (Hong Kong) report on Carrian or Philip Bowring's summary article on Carrian.

Wikipedia URL: Carrian Group

No Recent News

No recent news articles found for this case. Check back later for updates.

No Evidence Submitted

No evidence found for this case. Be the first to submit evidence in the comments below.

Join the discussion

Loading comments...

Carrian Group Founded

George Tan establishes Carrian Group in Hong Kong after fleeing Singapore.

Acquisition of CIL

Tan acquires a holding company, forming Carrian Investment Limited for HK$700 million.

Purchase of Gammon House

Carrian purchases Gammon House for HK$998 million, marking a record real estate deal.

Sale of Gammon House

Carrian announces the sale of Gammon House for HK$1.68 billion, boosting its public profile.

Banking Scandal Emerges

Carrian Group becomes embroiled in a scandal involving Bank Bumiputra Malaysia Berhad and accounting fraud.

Carrian Group Collapses

Carrian Group files for bankruptcy, marking the largest bankruptcy in Hong Kong's history.

Fraud Trial Opens

The trial related to the Carrian fraud scandal begins in Hong Kong, drawing significant media attention.

Defendants Acquitted

Hong Kong court acquits defendants in the Carrian fraud case, concluding a lengthy legal battle.

Carrian Group, a Hong Kong conglomerate founded by George Tan in 1977, collapsed in 1983 amidst a significant corruption and fraud scandal, marking the largest bankruptcy in Hong Kong's history. The group, which had rapidly expanded its operations across multiple countries, became embroiled in allegations of accounting fraud linked to Bank Bumiputra Malaysia Berhad and its subsidiary, culminating in the murder of a bank auditor and the suicide of a financial adviser. Key figures involved included founder George Tan and various banking officials, with the scandal revealing that the group's capital was primarily sourced from loans rather than legitimate investments. As of now, Carrian Group remains defunct, with little trace of its operations, although a restaurant named Carriana exists, loosely associated with the former conglomerate.

There are widespread beliefs that Carrian Group's rapid expansion was funded by questionable sources, with speculation linking its capital to figures such as Imelda Marcos, Gosbank, and a lumber corporation in Borneo. The collapse of the conglomerate amidst corruption and fraud allegations has led to theories about the extent of financial misconduct and the involvement of high-profile individuals in the scandal. Additionally, some speculate that the group's downfall was orchestrated by rival business interests aiming to undermine George Tan's influence in the market.

The Rise and Fall of the Carrian Group: A True Crime Saga

The Birth of a Conglomerate

In the bustling, opportunity-laden streets of Hong Kong, in 1977, a man named George Tan Soon-gin laid the foundation for what would become one of the most infamous conglomerates in history: the Carrian Group. Tan, a former Singaporean businessman who had fled his home country following a bankruptcy in 1974, sought a fresh start and a chance to build an empire from the ground up.

By 1979, Tan acquired a holding company for a staggering HK$700 million, transforming it into Carrian Investment Limited (CIL). This was no small feat, as Carrian Holdings Limited (CHL), a private entity, controlled 53% of CIL's equity, while another company, Carrian Nominee, held all shares of CHL. The stage was set for what would become an extraordinary, albeit short-lived, business saga.

A Spectacular Ascent

The dawn of the 1980s saw Carrian making headlines with an audacious real estate transaction. In January 1980, a 75% owned subsidiary of the group acquired Gammon House—now known as the Bank of America Tower—in Hong Kong's Central District for HK$998 million. This transaction marked the most expensive real estate purchase in Hong Kong's history at the time. Just a few months later, in April, Carrian announced the sale of Gammon House for an astounding HK$1.68 billion, raising eyebrows and capturing the attention of both property and financial markets. This maneuver not only generated a significant return on investment but also piqued public interest in the Carrian Group.

Seizing the momentum, Carrian capitalized on its newfound notoriety by acquiring a publicly listed company, renaming it Carrian Investments Ltd., and using it as a vehicle to draw funds from financial markets. The conglomerate grew at a breakneck pace, expanding its reach across the globe with properties in Malaysia, Thailand, Singapore, the Philippines, Japan, and the United States. As the empire expanded, so did the whispers of its mysterious financial backing. Was it the wealth of Imelda Marcos, the Soviet Union's Gosbank, or perhaps a lumber corporation in Borneo? The source of Carrian's vast capital remained a tantalizing mystery.

The Scandal and Collapse

The Carrian Group's meteoric rise was matched only by its catastrophic downfall. In 1983, the conglomerate became embroiled in a scandal involving Bank Bumiputra Malaysia Berhad and its Hong Kong subsidiary, Bumiputra Malaysia Finance. Allegations of accounting fraud surfaced, casting a shadow over Carrian's operations. The scandal deepened with the murder of a bank auditor and the suicide of the firm's advisor, events that shook the very foundations of Hong Kong's financial world.

By 1983, the Carrian Group had collapsed in what became the largest bankruptcy in Hong Kong's history. The scandal peeled back layers of secrecy, revealing that Carrian's seemingly endless capital was nothing more than a facade, propped up by loans from various banking institutions.

The Echoes of Carrian

In the aftermath of its downfall, almost no tangible traces of the Carrian Group remain. However, its legacy lingers in unexpected places. Carriana, a Hong Kong restaurant specializing in Teochew cuisine, was loosely named after the conglomerate due to connections between one of its former owners, Chim Pui-chung, and Carrian. Today, Carriana is a listed company in Hong Kong, a subtle nod to its infamous past.

During its heyday, Carrian dabbled in a myriad of ventures, from pesticides to tourism, shipping, insurance, taxi fleets, and restaurants. Yet, it was the real estate sector that remained its core business, the arena where its most dramatic successes and failures played out.

Carrian in Popular Culture

The intrigue surrounding the Carrian Group's rise and fall has not been lost on popular media. In 2020, the TVB drama series "Of Greed and Ants" explored the scandal's many facets, drawing inspiration from the real-life events that captivated Hong Kong. More recently, the 2023 film "The Goldfinger," produced and distributed by Emperor Motion Pictures, brought the saga to the silver screen, premiering on December 30, 2023.

Sources

For further exploration of the Carrian Group's dramatic history, interested readers can refer to the following resources:

- Vengadesan & Sagayam, 2019, p. 72.

- Naylor, 2004, p. 209.

- Fung, 2017, p. 45.

- "Carrian fraud trial opens in Hong Kong," The Sydney Morning Herald, February 19, 1986.

- "Carrian Receivers," The New York Times, October 19, 1983.

- Chow, Hin, "此馬來頭大的佳寧娜," am730, November 16, 2016.

- Bangsberg, P.T., "Hong Kong Acquits Defendants In Costly Carrian Fraud Case," joc.com, September 15, 1987.

- Wong, Zi Hang, "【黃金有罪】參考真實「佳寧案」," January 8, 2020.

- "专访《金手指》导演庄文强," January 1, 2024.

For more detailed analysis, check out the Independent Commission Against Corruption (Hong Kong) report on Carrian or Philip Bowring's summary article on Carrian.

Wikipedia URL: Carrian Group

No Recent News

No recent news articles found for this case. Check back later for updates.

No Evidence Submitted

No evidence found for this case. Be the first to submit evidence in the comments below.

Join the discussion

Loading comments...

Carrian Group Founded

George Tan establishes Carrian Group in Hong Kong after fleeing Singapore.

Acquisition of CIL

Tan acquires a holding company, forming Carrian Investment Limited for HK$700 million.

Purchase of Gammon House

Carrian purchases Gammon House for HK$998 million, marking a record real estate deal.

Sale of Gammon House

Carrian announces the sale of Gammon House for HK$1.68 billion, boosting its public profile.

Banking Scandal Emerges

Carrian Group becomes embroiled in a scandal involving Bank Bumiputra Malaysia Berhad and accounting fraud.

Carrian Group Collapses

Carrian Group files for bankruptcy, marking the largest bankruptcy in Hong Kong's history.

Fraud Trial Opens

The trial related to the Carrian fraud scandal begins in Hong Kong, drawing significant media attention.

Defendants Acquitted

Hong Kong court acquits defendants in the Carrian fraud case, concluding a lengthy legal battle.