NSE Co-Location Scam

Stock Market Manipulation Scheme

CLASSIFICATION: Financial Crime

LOCATION

India

TIME PERIOD

2010-2014

VICTIMS

0 confirmed

The NSE co-location scam involves alleged market manipulation at the National Stock Exchange of India, where select traders reportedly gained access to market price information ahead of others, enabling them to front-run trades. This manipulation is believed to have occurred from January 2010, when the co-location facility was introduced, until the scam was uncovered following a whistle-blower's complaint received by the Securities and Exchange Board of India (SEBI) in January 2015. Key figures include NSE executives and brokers, with investigations currently being conducted by the Central Bureau of Investigation (CBI), SEBI, and the Income Tax Department into the involvement of both current and former officials. The estimated financial impact of the fraud is around ₹500 billion over five years, and a recent notice was issued by the Madras High Court to SEBI and other regulatory bodies in response to a Public Interest Litigation filed by the Chennai Financial Markets and Accountability (CFMA).

Allegations suggest that select brokers colluded with NSE officials to manipulate market prices by gaining advance access to trading data through co-location facilities, enabling them to front run other market participants. Investigators are examining the potential involvement of both current and former NSE and SEBI executives in this scheme, with estimates of the fraud amounting to ₹500 billion over five years. The case has prompted legal actions, including a Public Interest Litigation against regulatory bodies like SEBI and the Ministry of Corporate Affairs.

The NSE Co-Location Scam: A Tale of Financial Manipulation

The Unveiling of a Financial Deception

The bustling world of stock exchanges is often a realm of numbers, algorithms, and split-second decisions. Yet, beneath the surface of this financial dynamism, a scandal was brewing at the heart of India's leading stock exchange, the National Stock Exchange (NSE). This was no ordinary case of market fluctuation but a calculated scheme that would shake the very foundations of financial integrity in India.

In January 2015, a whistleblower's anonymous letter arrived at the offices of the Securities and Exchange Board of India (SEBI), setting in motion a cascade of investigations. The letter alleged that certain brokers were exploiting a unique advantage—accessing market price information before the rest of the market, courtesy of their collusion with some NSE insiders. This was made possible through the manipulation of NSE's algorithmic trading and co-location servers. The estimated financial impact of this high-frequency trading (HFT) fraud amounted to a staggering ₹500 billion over five years.

The Co-Location Facility: A Step Towards Manipulation

The roots of this scandal trace back to January 2010 when the NSE introduced a co-location facility for its members. This facility allowed members to place their servers within the Exchange's premises, facilitating faster access to buy and sell orders broadcasted by the exchange's trading engine. In essence, those with co-location access could react to market changes faster than those relying on traditional means.

High-frequency trading, defined by the use of electronic systems to execute thousands of orders in milliseconds, was at the heart of this facility. Retail investors, relying on delayed data, were at a disadvantage compared to the live, tick-by-tick data provided to co-location users. Interestingly, SEBI bypassed the usual step of releasing a discussion paper for market feedback before permitting the co-location facility, a move shrouded in mystery and lacking transparency. At this time, Ravi Narain was the NSE's Managing Director, while C. B. Bhave chaired SEBI.

The Whistleblower's Revelation and SEBI's Response

The whistleblower's letter, also shared with the financial magazine Moneylife, described how savvy brokers had realized the advantage of being the first to connect to the fastest server. This advantage allowed them to game the system, bypassing SEBI's rules and regulations between 2010 and 2014. An insider revealed that access to co-location facilities granted select brokers a differential advantage, such as the ability to view market data and order books before execution.

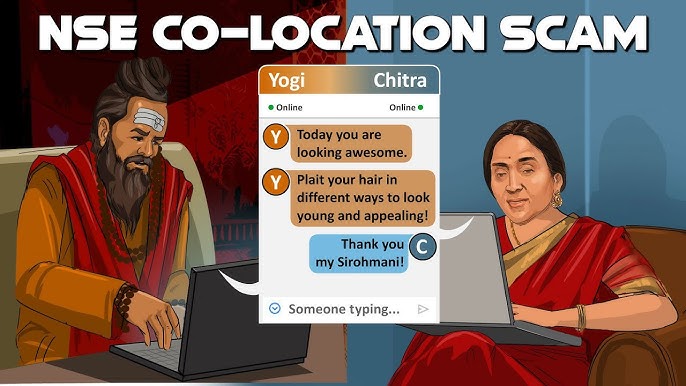

The Unraveling of Careers: Resignations at the NSE

As the allegations gained traction, the NSE faced a wave of resignations and internal turmoil. On May 22, 2017, SEBI issued show cause notices to the exchange and fourteen individuals, including former managing directors Chitra Ramakrishna and Ravi Narain. By June 2, 2017, Ravi Narain had resigned amid the intensifying scrutiny. Chitra Ramakrishna had already resigned in December 2016, a move partly attributed to governance issues and the co-location controversy. Their departures marked the end of an era for these founding members of the NSE.

In the aftermath, twelve of the fourteen executives, including Narain and Ramakrishna, sought to settle the matter through SEBI's consent mechanism, a process allowing resolution without admission of guilt. However, Vikram Limaye, the new MD and CEO, promised to address the issue head-on. Despite attempts to settle, SEBI returned the exchange's consent application in March 2018 as the Central Bureau of Investigation (CBI) intensified its probe.

Political Intrigue: The Allegations Against P. Chidambaram

The scandal's tendrils reached into the corridors of political power, with accusations against former Finance Minister P. Chidambaram. Allegedly, during his tenure from 2004 to 2014, he facilitated the NSE's high-frequency trading without SEBI's prior approval. His close ties with influential bureaucrats and financial market leaders, including Ravi Narain and Chitra Ramakrishna, were scrutinized. Critics alleged that Chidambaram's influence enabled brokers to exploit the NSE's systems for illegal gains.

The Role of Ajay Shah and Data Manipulation

At the heart of the technical manipulation was Ajay Shah, a former consultant with the Finance Ministry and an influential figure in financial research. Shah allegedly accessed NSE trade data under the guise of research, crafting algorithms that exploited the NSE's trading architecture. SEBI found that Shah and his wife, Susan Thomas, had secured a data-sharing agreement with the NSE, though they initially obtained data informally. Despite denials from NSE executives, evidence pointed to Shah's deep involvement.

Brokers in the Spotlight: The NSE Nexus

The scandal unveiled a disturbing nexus between brokers and the NSE. OPG Securities emerged as the prime beneficiary, enjoying multiple login IPs and preferential server access. Alongside OPG, other firms such as Alpha Grep, SMC Global, and Barclays Securities were implicated in benefiting from early server logins. Forensic audits by EY India and Deloitte revealed that 62 brokerages had exploited the NSE's HFT platform, with OPG Securities often first to access the servers.

SEBI's investigation alleged that OPG Securities earned close to ₹250 million in profit by leveraging its privileged access. The whistleblower claimed OPG's trades using co-location exceeded ₹60 billion, with the exchange's "order book" data aiding foreign investors in making illegal gains.

Conclusion

The NSE co-location scam stands as a stark reminder of the vulnerabilities within financial systems and the impact of unchecked power and influence. As investigations by SEBI, CBI, and other agencies continue, the full extent of the scandal remains to be seen. Yet, the revelations thus far have already cast a long shadow over the NSE, SEBI, and the broader financial landscape in India.

Sources

- Wikipedia: NSE Co-Location Scam

No Recent News

No recent news articles found for this case. Check back later for updates.

No Evidence Submitted

No evidence found for this case. Be the first to submit evidence in the comments below.

Join the discussion

Loading comments...

Whistle-blower Complaint

First anonymous complaint received by SEBI alleging market manipulation at NSE.

SEBI Issues Show Cause Notices

SEBI issued show cause notices to NSE and 14 individuals, including former managing directors.

Ravi Narain Resigns

Ravi Narain resigns as vice-chairman of NSE amid intensifying regulatory probes.

CBI FIR Filed

CBI filed a FIR against individuals for criminal conspiracy related to the NSE co-location scam.

SEBI Orders Against NSE

SEBI directed NSE to pay ₹6.25 billion and barred it from raising money for six months.

Sanjay Gupta Arrested

OPG Securities MD Sanjay Gupta arrested in connection with the NSE co-location case.

New NSE CEO Appointed

Ashishkumar Chauhan's appointment as the new MD and CEO of NSE accepted by SEBI.

Sanjay Pandey Arrested

Former Mumbai Police Commissioner Sanjay Pandey arrested in connection with illegal phone tapping.

Bail Argument Against Ramkrishna

ED argues against Chitra Ramkrishna's bail, calling her the mastermind behind the conspiracy.

The NSE co-location scam involves alleged market manipulation at the National Stock Exchange of India, where select traders reportedly gained access to market price information ahead of others, enabling them to front-run trades. This manipulation is believed to have occurred from January 2010, when the co-location facility was introduced, until the scam was uncovered following a whistle-blower's complaint received by the Securities and Exchange Board of India (SEBI) in January 2015. Key figures include NSE executives and brokers, with investigations currently being conducted by the Central Bureau of Investigation (CBI), SEBI, and the Income Tax Department into the involvement of both current and former officials. The estimated financial impact of the fraud is around ₹500 billion over five years, and a recent notice was issued by the Madras High Court to SEBI and other regulatory bodies in response to a Public Interest Litigation filed by the Chennai Financial Markets and Accountability (CFMA).

Allegations suggest that select brokers colluded with NSE officials to manipulate market prices by gaining advance access to trading data through co-location facilities, enabling them to front run other market participants. Investigators are examining the potential involvement of both current and former NSE and SEBI executives in this scheme, with estimates of the fraud amounting to ₹500 billion over five years. The case has prompted legal actions, including a Public Interest Litigation against regulatory bodies like SEBI and the Ministry of Corporate Affairs.

The NSE Co-Location Scam: A Tale of Financial Manipulation

The Unveiling of a Financial Deception

The bustling world of stock exchanges is often a realm of numbers, algorithms, and split-second decisions. Yet, beneath the surface of this financial dynamism, a scandal was brewing at the heart of India's leading stock exchange, the National Stock Exchange (NSE). This was no ordinary case of market fluctuation but a calculated scheme that would shake the very foundations of financial integrity in India.

In January 2015, a whistleblower's anonymous letter arrived at the offices of the Securities and Exchange Board of India (SEBI), setting in motion a cascade of investigations. The letter alleged that certain brokers were exploiting a unique advantage—accessing market price information before the rest of the market, courtesy of their collusion with some NSE insiders. This was made possible through the manipulation of NSE's algorithmic trading and co-location servers. The estimated financial impact of this high-frequency trading (HFT) fraud amounted to a staggering ₹500 billion over five years.

The Co-Location Facility: A Step Towards Manipulation

The roots of this scandal trace back to January 2010 when the NSE introduced a co-location facility for its members. This facility allowed members to place their servers within the Exchange's premises, facilitating faster access to buy and sell orders broadcasted by the exchange's trading engine. In essence, those with co-location access could react to market changes faster than those relying on traditional means.

High-frequency trading, defined by the use of electronic systems to execute thousands of orders in milliseconds, was at the heart of this facility. Retail investors, relying on delayed data, were at a disadvantage compared to the live, tick-by-tick data provided to co-location users. Interestingly, SEBI bypassed the usual step of releasing a discussion paper for market feedback before permitting the co-location facility, a move shrouded in mystery and lacking transparency. At this time, Ravi Narain was the NSE's Managing Director, while C. B. Bhave chaired SEBI.

The Whistleblower's Revelation and SEBI's Response

The whistleblower's letter, also shared with the financial magazine Moneylife, described how savvy brokers had realized the advantage of being the first to connect to the fastest server. This advantage allowed them to game the system, bypassing SEBI's rules and regulations between 2010 and 2014. An insider revealed that access to co-location facilities granted select brokers a differential advantage, such as the ability to view market data and order books before execution.

The Unraveling of Careers: Resignations at the NSE

As the allegations gained traction, the NSE faced a wave of resignations and internal turmoil. On May 22, 2017, SEBI issued show cause notices to the exchange and fourteen individuals, including former managing directors Chitra Ramakrishna and Ravi Narain. By June 2, 2017, Ravi Narain had resigned amid the intensifying scrutiny. Chitra Ramakrishna had already resigned in December 2016, a move partly attributed to governance issues and the co-location controversy. Their departures marked the end of an era for these founding members of the NSE.

In the aftermath, twelve of the fourteen executives, including Narain and Ramakrishna, sought to settle the matter through SEBI's consent mechanism, a process allowing resolution without admission of guilt. However, Vikram Limaye, the new MD and CEO, promised to address the issue head-on. Despite attempts to settle, SEBI returned the exchange's consent application in March 2018 as the Central Bureau of Investigation (CBI) intensified its probe.

Political Intrigue: The Allegations Against P. Chidambaram

The scandal's tendrils reached into the corridors of political power, with accusations against former Finance Minister P. Chidambaram. Allegedly, during his tenure from 2004 to 2014, he facilitated the NSE's high-frequency trading without SEBI's prior approval. His close ties with influential bureaucrats and financial market leaders, including Ravi Narain and Chitra Ramakrishna, were scrutinized. Critics alleged that Chidambaram's influence enabled brokers to exploit the NSE's systems for illegal gains.

The Role of Ajay Shah and Data Manipulation

At the heart of the technical manipulation was Ajay Shah, a former consultant with the Finance Ministry and an influential figure in financial research. Shah allegedly accessed NSE trade data under the guise of research, crafting algorithms that exploited the NSE's trading architecture. SEBI found that Shah and his wife, Susan Thomas, had secured a data-sharing agreement with the NSE, though they initially obtained data informally. Despite denials from NSE executives, evidence pointed to Shah's deep involvement.

Brokers in the Spotlight: The NSE Nexus

The scandal unveiled a disturbing nexus between brokers and the NSE. OPG Securities emerged as the prime beneficiary, enjoying multiple login IPs and preferential server access. Alongside OPG, other firms such as Alpha Grep, SMC Global, and Barclays Securities were implicated in benefiting from early server logins. Forensic audits by EY India and Deloitte revealed that 62 brokerages had exploited the NSE's HFT platform, with OPG Securities often first to access the servers.

SEBI's investigation alleged that OPG Securities earned close to ₹250 million in profit by leveraging its privileged access. The whistleblower claimed OPG's trades using co-location exceeded ₹60 billion, with the exchange's "order book" data aiding foreign investors in making illegal gains.

Conclusion

The NSE co-location scam stands as a stark reminder of the vulnerabilities within financial systems and the impact of unchecked power and influence. As investigations by SEBI, CBI, and other agencies continue, the full extent of the scandal remains to be seen. Yet, the revelations thus far have already cast a long shadow over the NSE, SEBI, and the broader financial landscape in India.

Sources

- Wikipedia: NSE Co-Location Scam

No Recent News

No recent news articles found for this case. Check back later for updates.

No Evidence Submitted

No evidence found for this case. Be the first to submit evidence in the comments below.

Join the discussion

Loading comments...

Whistle-blower Complaint

First anonymous complaint received by SEBI alleging market manipulation at NSE.

SEBI Issues Show Cause Notices

SEBI issued show cause notices to NSE and 14 individuals, including former managing directors.

Ravi Narain Resigns

Ravi Narain resigns as vice-chairman of NSE amid intensifying regulatory probes.

CBI FIR Filed

CBI filed a FIR against individuals for criminal conspiracy related to the NSE co-location scam.

SEBI Orders Against NSE

SEBI directed NSE to pay ₹6.25 billion and barred it from raising money for six months.

Sanjay Gupta Arrested

OPG Securities MD Sanjay Gupta arrested in connection with the NSE co-location case.

New NSE CEO Appointed

Ashishkumar Chauhan's appointment as the new MD and CEO of NSE accepted by SEBI.

Sanjay Pandey Arrested

Former Mumbai Police Commissioner Sanjay Pandey arrested in connection with illegal phone tapping.

Bail Argument Against Ramkrishna

ED argues against Chitra Ramkrishna's bail, calling her the mastermind behind the conspiracy.