Polly Peck

Corporate Fraud and Theft

CLASSIFICATION: Financial Crime

LOCATION

London, UK

TIME PERIOD

1991-2012

VICTIMS

1 confirmed

Polly Peck International (PPI), a British textile company, collapsed in 1991 with debts of £1.3 billion, leading to the flight of its CEO, Asil Nadir, to Northern Cyprus in 1993. Nadir was accused of embezzling over £150 million from the company, which sparked a significant corporate scandal that contributed to reforms in UK company law. After returning to the UK on 26 August 2010 to clear his name, Nadir faced trial on 13 charges related to theft, ultimately being found guilty on 10 counts totaling £29 million. On 23 August 2012, he was sentenced to 10 years in prison, marking a notable resolution to a high-profile case in corporate crime. Key evidence included financial records and testimonies that substantiated the allegations of misappropriation of funds.

Asil Nadir is believed to have orchestrated a complex scheme to siphon off substantial funds from Polly Peck, with speculation that he may have had accomplices in his fraudulent activities. Some theorists suggest that his flight to Northern Cyprus was premeditated to evade prosecution and that he had connections that facilitated his escape and subsequent return to the UK. Additionally, there are theories that the rapid expansion of Polly Peck and its eventual collapse were indicative of broader issues within corporate governance during that era, leading to calls for reform in the UK company law.

The Rise and Fall of Polly Peck: A Saga of Ambition and Deception

Beginnings in Fashion

In the heart of England during the tumultuous year of 1940, a small fashion house emerged from the collaborative efforts of Raymond and Sybil Zelker. Named Polly Peck, this enterprise was more than just a business; it was a testament to the Zelkers' vision—Sybil crafting the designs and Raymond managing the business affairs. Over the years, the company clawed its way up, navigating the competitive world of fashion in Britain.

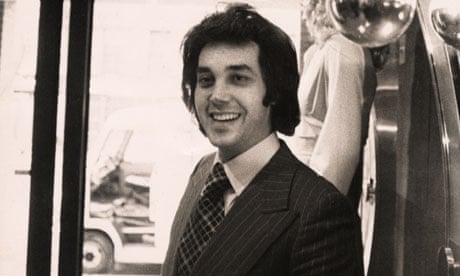

A New Era with Asil Nadir

By the late 1970s, Polly Peck was struggling. But as the dawn of the 1980s approached, a new chapter began. Asil Nadir, a man with an ambitious vision, took control in 1980 through Restro Investments, acquiring 58% of the company for a mere £270,000. Within days, Nadir initiated a rights issue to raise £1.5 million, aiming to inject new life into Polly Peck through overseas investments.

Nadir's strategy was clear: diversification and expansion. By 1982, he had ventured into packaging, hospitality, and citrus trading in the Turkish Republic of Northern Cyprus, with companies like Uni-Pac Packaging Industries Ltd and Sunzest Trading Ltd. His vision extended to textiles, acquiring a major stake in Cornell, a textile trader, and establishing operations in Turkey with the Niksar mineral water bottling plant. Polly Peck was transforming from a niche fashion house into a sprawling international conglomerate.

A Meteoric Rise

Throughout the 1980s, Polly Peck's growth was nothing short of meteoric. Nadir expanded the textile business further, acquiring stakes in Santana Inc. in the United States and InterCity PLC in the UK. He pushed into the Far East by securing the Impact Textile Group and strengthening positions in Shuihing Ltd. and Palmon (UAE) Ltd. Polly Peck's empire was expanding on every continent.

In 1984, a bold step into electronics with an 82% stake in Vestel Electronics in Turkey diversified Polly Peck's portfolio into consumer electronics. This move was bolstered by partnerships with Japanese brands like Akai. By 1989, Polly Peck had become an international powerhouse, acquiring Sansui, a Japanese electronics company, and purchasing the Del Monte fresh fruit division for $875 million. Polly Peck had earned its place in the prestigious FTSE 100 Index that year.

Seeds of Collapse

Despite its success, cracks began to appear in the foundation of Polly Peck. By 1990, Nadir believed the company was undervalued and considered taking it private, only to abruptly change his mind. Behind the scenes, irregularities were surfacing. An investigation revealed that Polly Peck had made substantial payments to subsidiaries in Turkey and Northern Cyprus, raising red flags about the company's financial practices. These funds, totaling £141 million in 1989 alone, were unaccounted for.

The Inland Revenue began scrutinizing transactions involving a Swiss nominee company, Fax Investments, linked to Nadir's son. Assets worth millions were suspiciously registered in Nadir's name, while others had no registered owner at all. The situation was precarious, and the company's financial structure was under strain from short-term debts and long-term loans.

The Fall of Polly Peck

On September 20, 1990, the Serious Fraud Office raided South Audley Management, the custodian of the Nadir family's interests. The raid sent shockwaves through the financial world, triggering a panic sell-off of Polly Peck shares and resulting in the suspension of their trading. By October 1990, the company was in provisional liquidation, and by November, it was in administration.

Asil Nadir faced charges of false accounting and theft, denying any wrongdoing. But the evidence was overwhelming. In 1991, PPI's shares in Vestel Electronics were transferred to Collar Holding BV, which was later acquired by Ahmet Nazif Zorlu in 1994.

Flight and Pursuit of Justice

Nadir's departure from the UK was as dramatic as his rise. Evading arrest just after his bail had lapsed, he fled to Northern Cyprus, a territory without an extradition treaty with the UK. Elizabeth Forsyth, his aide, was convicted of laundering Polly Peck funds, though her conviction was later overturned on appeal. Meanwhile, a political scandal unfolded as government minister Michael Mates resigned due to his connections with Nadir.

Despite his claims of innocence and accusations against the Serious Fraud Office, Nadir's empire crumbled. His properties were sold to pay debts, and his influence waned. Yet, in a bold move, Nadir sought to return to the UK in 2010, facing 66 counts of theft. Granted bail with conditions, including a curfew and electronic tagging, he stood trial in 2012.

Guilty as Charged

On August 22, 2012, the verdict was delivered at the Old Bailey: Nadir was guilty on ten counts of theft, totaling £29 million. Though acquitted on three charges, the outcome was clear. He was sentenced to ten years in prison, a stunning fall from grace for the man who once led a global empire.

Sources

For more information, visit the original Wikipedia article: Polly Peck

No Recent News

No recent news articles found for this case. Check back later for updates.

No Evidence Submitted

No evidence found for this case. Be the first to submit evidence in the comments below.

Join the discussion

Loading comments...

Company Founded

Polly Peck International is founded by Raymond and Sybil Zelker.

Asil Nadir Becomes CEO

Asil Nadir takes over as Chief Executive of Polly Peck.

FTSE 100 Inclusion

Polly Peck is admitted to the FTSE 100 Share Index.

SFO Raids Company

The Serious Fraud Office conducts a raid on Polly Peck, triggering a run on shares.

Company Collapses

Polly Peck goes into administration with debts of £1.3 billion.

Nadir Flees to Cyprus

Asil Nadir flees the UK to Northern Cyprus to avoid prosecution.

Nadir Returns to UK

Asil Nadir returns to the UK to face charges after 17 years as a fugitive.

Trial Begins

Asil Nadir's trial starts on charges of theft and false accounting.

Nadir Found Guilty

Asil Nadir is found guilty on ten counts of theft totaling nearly £29 million.

Sentenced to Prison

Asil Nadir is sentenced to ten years in prison for his crimes.

Polly Peck International (PPI), a British textile company, collapsed in 1991 with debts of £1.3 billion, leading to the flight of its CEO, Asil Nadir, to Northern Cyprus in 1993. Nadir was accused of embezzling over £150 million from the company, which sparked a significant corporate scandal that contributed to reforms in UK company law. After returning to the UK on 26 August 2010 to clear his name, Nadir faced trial on 13 charges related to theft, ultimately being found guilty on 10 counts totaling £29 million. On 23 August 2012, he was sentenced to 10 years in prison, marking a notable resolution to a high-profile case in corporate crime. Key evidence included financial records and testimonies that substantiated the allegations of misappropriation of funds.

Asil Nadir is believed to have orchestrated a complex scheme to siphon off substantial funds from Polly Peck, with speculation that he may have had accomplices in his fraudulent activities. Some theorists suggest that his flight to Northern Cyprus was premeditated to evade prosecution and that he had connections that facilitated his escape and subsequent return to the UK. Additionally, there are theories that the rapid expansion of Polly Peck and its eventual collapse were indicative of broader issues within corporate governance during that era, leading to calls for reform in the UK company law.

The Rise and Fall of Polly Peck: A Saga of Ambition and Deception

Beginnings in Fashion

In the heart of England during the tumultuous year of 1940, a small fashion house emerged from the collaborative efforts of Raymond and Sybil Zelker. Named Polly Peck, this enterprise was more than just a business; it was a testament to the Zelkers' vision—Sybil crafting the designs and Raymond managing the business affairs. Over the years, the company clawed its way up, navigating the competitive world of fashion in Britain.

A New Era with Asil Nadir

By the late 1970s, Polly Peck was struggling. But as the dawn of the 1980s approached, a new chapter began. Asil Nadir, a man with an ambitious vision, took control in 1980 through Restro Investments, acquiring 58% of the company for a mere £270,000. Within days, Nadir initiated a rights issue to raise £1.5 million, aiming to inject new life into Polly Peck through overseas investments.

Nadir's strategy was clear: diversification and expansion. By 1982, he had ventured into packaging, hospitality, and citrus trading in the Turkish Republic of Northern Cyprus, with companies like Uni-Pac Packaging Industries Ltd and Sunzest Trading Ltd. His vision extended to textiles, acquiring a major stake in Cornell, a textile trader, and establishing operations in Turkey with the Niksar mineral water bottling plant. Polly Peck was transforming from a niche fashion house into a sprawling international conglomerate.

A Meteoric Rise

Throughout the 1980s, Polly Peck's growth was nothing short of meteoric. Nadir expanded the textile business further, acquiring stakes in Santana Inc. in the United States and InterCity PLC in the UK. He pushed into the Far East by securing the Impact Textile Group and strengthening positions in Shuihing Ltd. and Palmon (UAE) Ltd. Polly Peck's empire was expanding on every continent.

In 1984, a bold step into electronics with an 82% stake in Vestel Electronics in Turkey diversified Polly Peck's portfolio into consumer electronics. This move was bolstered by partnerships with Japanese brands like Akai. By 1989, Polly Peck had become an international powerhouse, acquiring Sansui, a Japanese electronics company, and purchasing the Del Monte fresh fruit division for $875 million. Polly Peck had earned its place in the prestigious FTSE 100 Index that year.

Seeds of Collapse

Despite its success, cracks began to appear in the foundation of Polly Peck. By 1990, Nadir believed the company was undervalued and considered taking it private, only to abruptly change his mind. Behind the scenes, irregularities were surfacing. An investigation revealed that Polly Peck had made substantial payments to subsidiaries in Turkey and Northern Cyprus, raising red flags about the company's financial practices. These funds, totaling £141 million in 1989 alone, were unaccounted for.

The Inland Revenue began scrutinizing transactions involving a Swiss nominee company, Fax Investments, linked to Nadir's son. Assets worth millions were suspiciously registered in Nadir's name, while others had no registered owner at all. The situation was precarious, and the company's financial structure was under strain from short-term debts and long-term loans.

The Fall of Polly Peck

On September 20, 1990, the Serious Fraud Office raided South Audley Management, the custodian of the Nadir family's interests. The raid sent shockwaves through the financial world, triggering a panic sell-off of Polly Peck shares and resulting in the suspension of their trading. By October 1990, the company was in provisional liquidation, and by November, it was in administration.

Asil Nadir faced charges of false accounting and theft, denying any wrongdoing. But the evidence was overwhelming. In 1991, PPI's shares in Vestel Electronics were transferred to Collar Holding BV, which was later acquired by Ahmet Nazif Zorlu in 1994.

Flight and Pursuit of Justice

Nadir's departure from the UK was as dramatic as his rise. Evading arrest just after his bail had lapsed, he fled to Northern Cyprus, a territory without an extradition treaty with the UK. Elizabeth Forsyth, his aide, was convicted of laundering Polly Peck funds, though her conviction was later overturned on appeal. Meanwhile, a political scandal unfolded as government minister Michael Mates resigned due to his connections with Nadir.

Despite his claims of innocence and accusations against the Serious Fraud Office, Nadir's empire crumbled. His properties were sold to pay debts, and his influence waned. Yet, in a bold move, Nadir sought to return to the UK in 2010, facing 66 counts of theft. Granted bail with conditions, including a curfew and electronic tagging, he stood trial in 2012.

Guilty as Charged

On August 22, 2012, the verdict was delivered at the Old Bailey: Nadir was guilty on ten counts of theft, totaling £29 million. Though acquitted on three charges, the outcome was clear. He was sentenced to ten years in prison, a stunning fall from grace for the man who once led a global empire.

Sources

For more information, visit the original Wikipedia article: Polly Peck

No Recent News

No recent news articles found for this case. Check back later for updates.

No Evidence Submitted

No evidence found for this case. Be the first to submit evidence in the comments below.

Join the discussion

Loading comments...

Company Founded

Polly Peck International is founded by Raymond and Sybil Zelker.

Asil Nadir Becomes CEO

Asil Nadir takes over as Chief Executive of Polly Peck.

FTSE 100 Inclusion

Polly Peck is admitted to the FTSE 100 Share Index.

SFO Raids Company

The Serious Fraud Office conducts a raid on Polly Peck, triggering a run on shares.

Company Collapses

Polly Peck goes into administration with debts of £1.3 billion.

Nadir Flees to Cyprus

Asil Nadir flees the UK to Northern Cyprus to avoid prosecution.

Nadir Returns to UK

Asil Nadir returns to the UK to face charges after 17 years as a fugitive.

Trial Begins

Asil Nadir's trial starts on charges of theft and false accounting.

Nadir Found Guilty

Asil Nadir is found guilty on ten counts of theft totaling nearly £29 million.

Sentenced to Prison

Asil Nadir is sentenced to ten years in prison for his crimes.